Seller Management: The Growth Engine Behind Scalable Marketplaces

March 2nd, 2026 Posted by Steve Paul Insights, Marketplaces, Retail 0 thoughts on “Seller Management: The Growth Engine Behind Scalable Marketplaces”Seller management has quietly become one of the most powerful growth levers in modern marketplaces. Not because marketplaces list more products, but because—when seller participation is designed and managed well—they generate a continuous flow of high-quality, first-party signals. These signals increasingly shape discovery, conversion, engagement, and long-term growth.

This shift matters now more than ever. As marketplaces layer in retail media, promotions, fulfilment commitments, and monetisation models, growth increasingly depends on the quality and timeliness of seller-generated signals—not just the size of the catalogue.

In many organisations, seller management still sits in the background. Teams often treat it as a functional necessity that covers onboarding, catalogue uploads, compliance checks, and support tickets. In practice, however, seller management now plays a far more strategic role. It directly influences marketplace liquidity, data quality, and scalability.

As marketplaces mature and evolve into broader platforms, the way sellers are managed—and empowered—becomes decisive. Increasingly, it determines whether a marketplace compounds or plateaus.

Marketplaces Are No Longer Just Transaction Engines

Traditional ecommerce models optimise within a single organisation. Marketplaces operate very differently. Control is distributed across independent sellers, and outcomes emerge from how effectively participation is coordinated.

As a result, successful marketplaces no longer win by simply aggregating supply. Instead, they win by orchestrating participation.

Every seller interaction creates signals. Onboarding decisions, pricing updates, availability changes, and promotional activity all generate data points. Over time, these signals become immensely valuable. They influence search relevance, ranking logic, assortment quality, fulfilment reliability, and buyer trust.

For this reason, leading marketplace operators no longer talk about “seller operations” alone. They increasingly think in terms of seller ecosystems.

When designed well, a seller ecosystem improves participation quality and reduces friction for buyers. It also creates more consistent patterns of behaviour across the marketplace. By contrast, poorly designed seller management introduces noise. Inconsistent pricing, unreliable availability, and stale data quietly undermine trust and constrain growth.

Seller Signals Are the Real Marketplace Advantage

As marketplaces scale, competitive advantage shifts. Surface-level features matter less, while the quality of underlying signals matters more.

In marketplace environments, sellers act as active participants in the data economy. Their pricing strategies, responsiveness, promotional behaviour, and inventory decisions feed directly into the signal layer that powers marketplace performance.

In practice, these signals show up in everyday seller actions, such as pricing updates, promotion participation, inventory accuracy, fulfilment reliability, and responsiveness to demand. Individually, each action seems minor. Collectively, they determine how effectively a marketplace matches intent, maintains trust, and scales sustainably.

Over time, this dynamic compounds.

More engaged sellers generate richer behavioural signals. In turn, richer signals enable better discovery, more accurate matching of intent, and more consistent buyer outcomes. As a result, participation and performance begin to reinforce one another.

However, this flywheel only works when seller data remains clean, timely, and consistent. Crucially, seller management determines whether that condition holds.

Why Self-Service Becomes a Strategic Requirement

As marketplaces grow, manual seller operations break down quickly. Ticket queues lengthen. Changes lag behind reality. Data quality deteriorates. Gradually, the marketplace begins optimising against outdated information.

This is why self-service is not a convenience feature. Instead, it acts as a scaling mechanism.

When sellers can onboard themselves, manage catalogues, adjust pricing, control availability, and participate in promotions directly, two things happen. First, operational friction drops. Second—and more importantly—signal quality improves.

Self-service introduces immediacy into the signal layer. Prices reflect intent. Inventory reflects reality. Promotions reflect strategy rather than backlog. As a result, the marketplace stops reacting after the fact and starts responding in near real time.

At scale, seller management determines whether self-service strengthens signal quality or simply accelerates inconsistency.

From Static Marketplaces to Adaptive Systems

Many marketplaces still rely on static optimisation cycles. Rules update periodically, performance reviews happen retrospectively, and interventions arrive with delay. While these models can support early growth, they struggle as complexity increases.

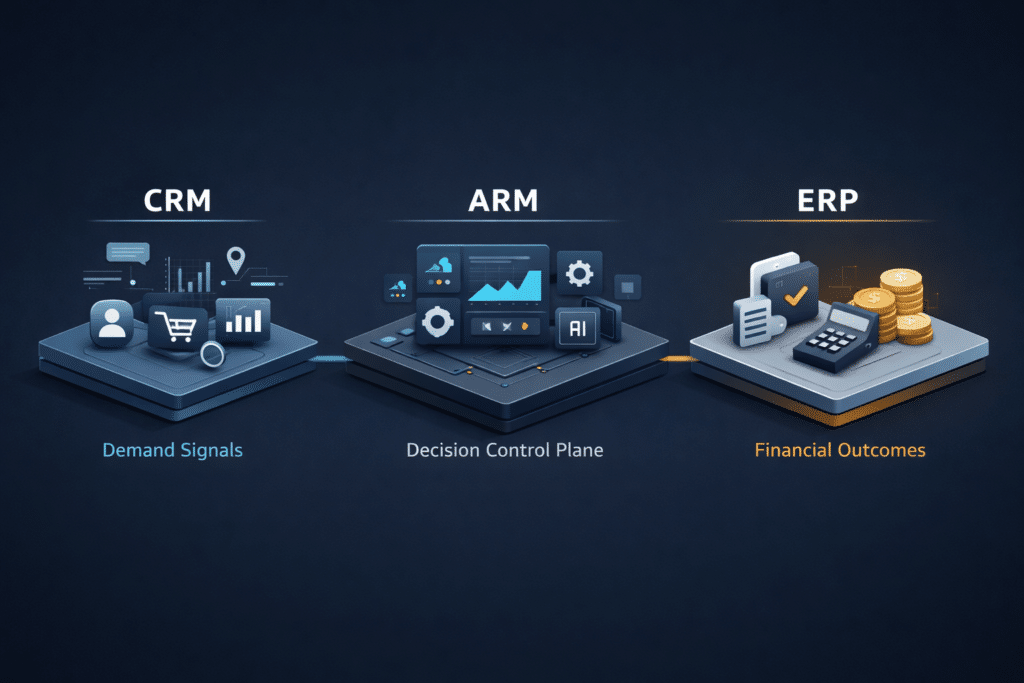

By contrast, adaptive marketplaces operate differently. They ingest signals continuously and respond dynamically. Pricing, availability, ranking, and participation mechanisms evolve alongside seller and buyer behaviour rather than lagging behind it.

Crucially, this shift is not primarily a technology challenge. Instead, it is a design challenge. It begins with how organisations onboard sellers, define participation rules, and govern activity over time.

Final Thought

Marketplaces that treat seller management as an administrative layer will eventually stall. Those that treat seller management as a strategic engine—designed around participation, signal quality, and adaptability—create the conditions for sustained growth.

This article is the first in a series exploring how modern marketplaces really scale. Rather than focusing on features alone, the series examines the systems and decisions that shape behaviour at scale.

At Trigg, we spend a great deal of time working with organisations navigating this shift in practice. If you are navigating marketplace complexity — seller scale, signal quality, or participation design — this series is written for you.